30+

Financial actors trust us

20+

Widgets

100+

Platform members

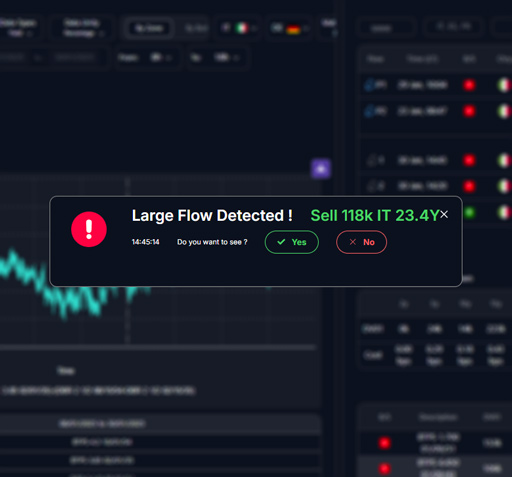

Flows tracking

Flow services offer real-time insights and market intelligence, enabling clients to maximize liquidity and stay ahead of market trends by leveraging dynamic data.

Market event analysis

Market events services provide real-time updates on auctions, central bank meetings, and economic publications. This enables clients to stay informed and react swiftly to market changes. Statistical tools synthesize multiple years of complex data to enhance macroeconomic awareness.

Patterns Deciphering

Pattern services identify recurrent market behaviors, extracting actionable insights from price action and order book data. As history tends to repeat itself, Quantfox’s tools make it easy for users to trade based on recurring patterns.

Relative Value Detection

Relative value services identify price distortions, stretched levels, and trading opportunities. Connecting these market discrepancies to flows and liquidity allows for optimal expression of market views.

Our technology

Improving decision-making at every step of the investment process

The QuantFox platform is distinguished by its highly customizable interface, featuring widgets and tools tailored to the specific needs of its users. This enables clients to adjust the platform to fit their unique trading strategies and preferences, ensuring optimal usability and effectiveness.

Customizable

Trading

Tools

Data charts

Guide

Embrace the future of financeby choosing Quantfox

Smart Data leveraged by AI at your advantage.

Any questions ?

Connect with our team to get personalized answers and insights tailored to your trading needs.

Book a callInterested ?

See our AI-powered platform in action. Book a demo to explore its full potential for your goals.

Book a demo