Unleashing the power of AI for

fixed-income trading

Transformative market analytics directly actionable.

Financial actors trust us

Widgets

Platform members

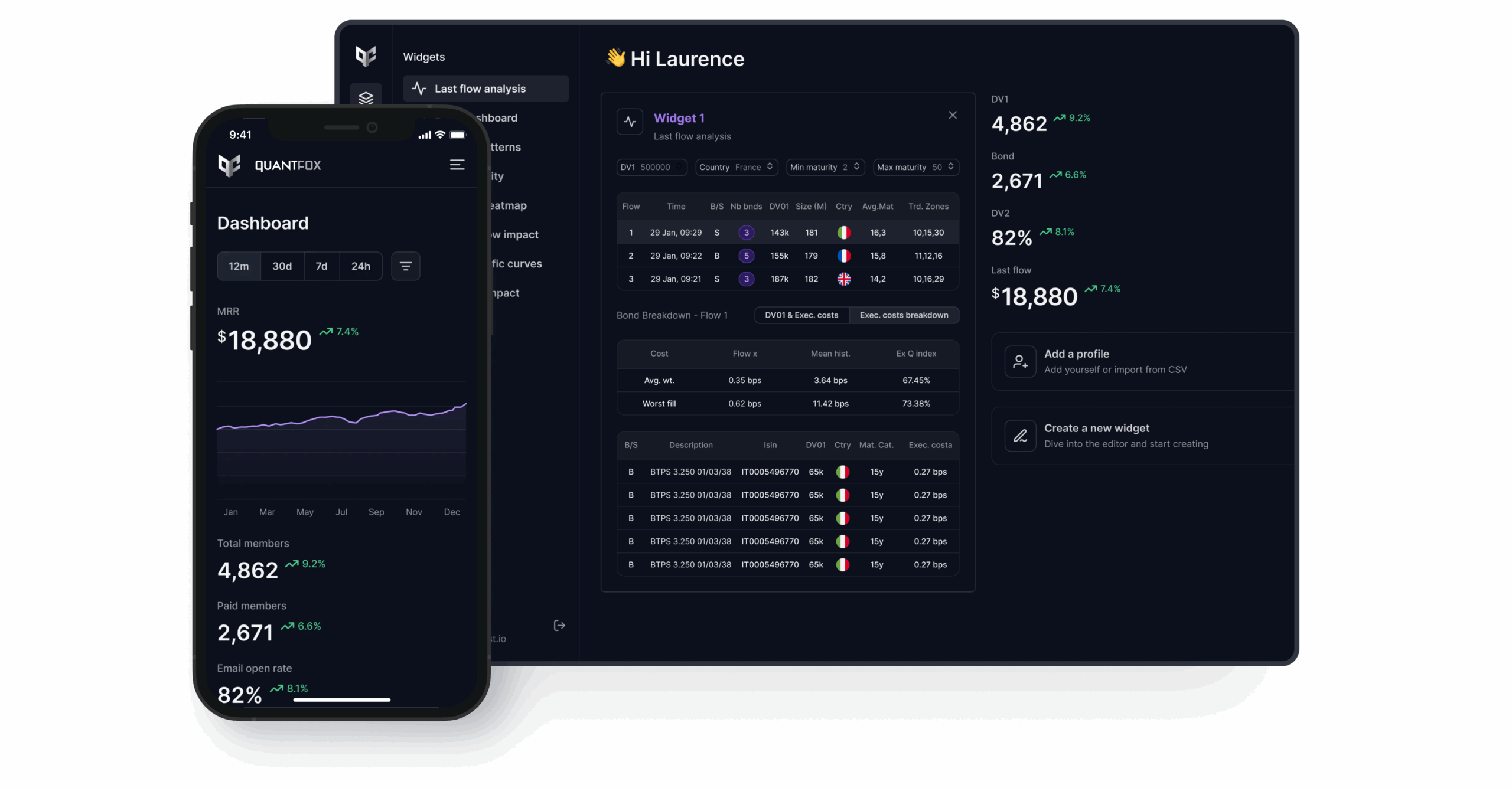

QuantFox empowers Fixed Income Markets actors within banks, hedge funds, asset managers, and other institutional investors.

Our tool provides access to live leading indicators to improve trading decisions. Built on advanced AI technology, QuantFox platform transforms live data into actionable trading opportunities.

Book a 15 mns callTransforming complex data processes into live actionable Analytics.

Building predictive models relying on the most pertinent data to improve decision-making.

Innovating financial strategies with cutting-edge technology.

Empowering teams to integrate Quantfox unique statistical tools into everyday operations effectively.

Quantfox makes users lives easier and allows them to concentrate on what matters most: capturing market opportunities before it’s too late.

Traders need live, actionable, market data to seize opportunities first.

Collecting data is difficult, time-consuming, and often unreliable. In fixed-income markets, complex instruments make accurate analysis harder.

Traders’ tools, often Excel sheets, lack robustness and consistency. In an age where almost anything can be done with 3 clicks on our phones, why are traders still working this way?

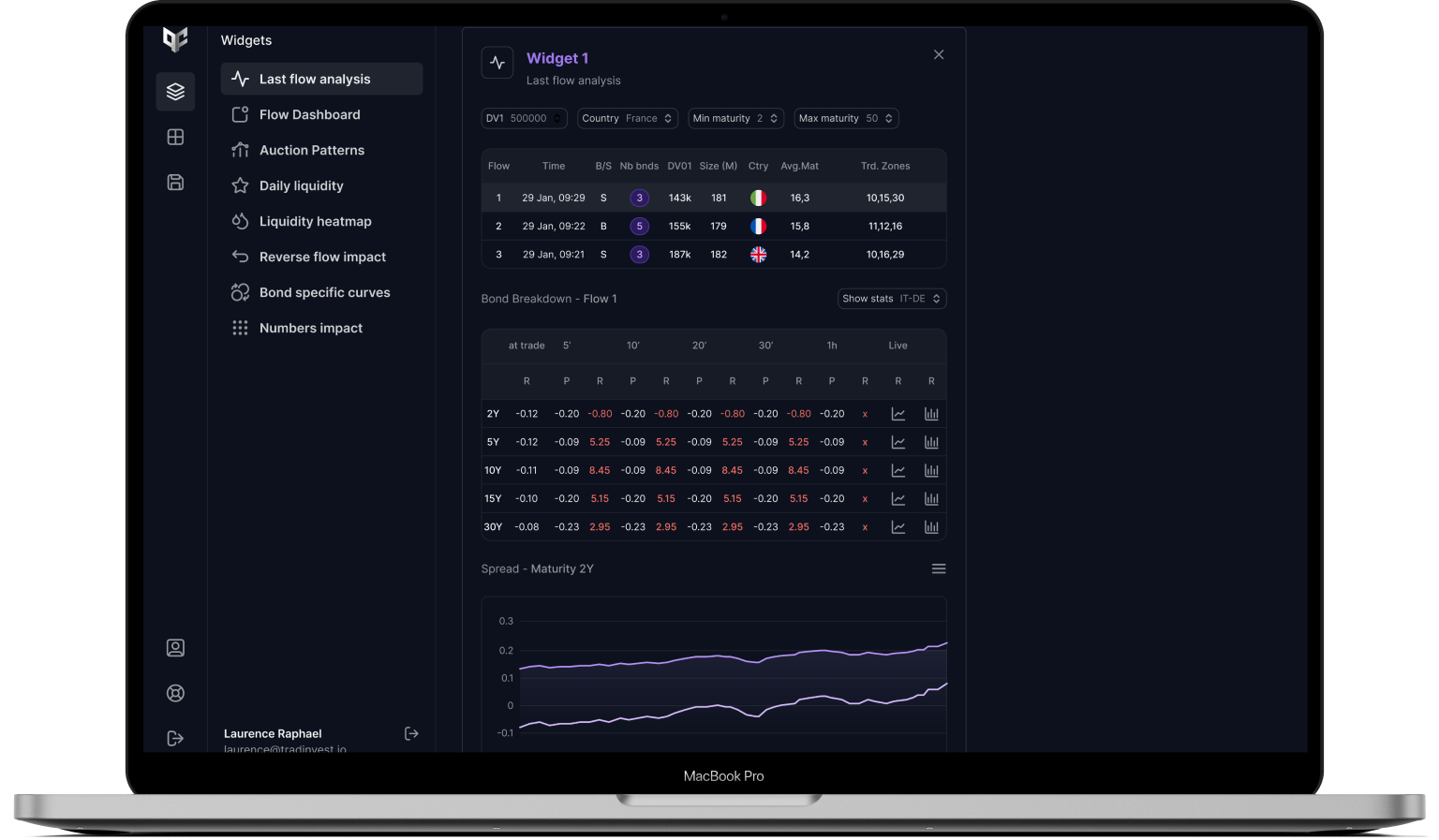

Advanced technology to anticipate, detect and flag large transactions in real-time.

Projecting asset prices patterns around major events such as auctions, economic publications, central banks meetings.

Estimation of market impacts and bid-offer costs for specific transactions. Allowing investors to maximize performance and optimize order executions.

Leveraging comprehensive trading history and volume insights to identify market distortions through predictive models.